Jakarta, GIC Trade – The pound reached a one-month high against the US dollar amid expectations of a smaller Fed benchmark rate hike and upbeat economic data weighed on the greenback's safe haven.

Market participants now seem confident that the Fed may be nearing the end of its rate-hike cycle amid signs of easing inflationary pressures.

Where investors expect that the Fed interest rate will be smaller in the future after the release of the United States (US) consumer price index (CPI) data in December showed that the CPI fell for the first time in more than two and a half years.

In addition, US central bank officials also supported the case of raising interest rates by only 25 basis points (bps) at the policy meeting in February 2023. The market now expects a 91% chance for a 25 bps hike and a 9% chance for a 50 bps hike.

However, rising recession fears triggered by the recent spread of the Covid-19 outbreak in China and ongoing geopolitical tensions between Russia and Ukraine have limited market optimism.

Market participants also seem reluctant to take a big position in the GBP/USD pair ahead of Bank of England (BoE) Governor Andrew Bailey's speech later in the evening. Meanwhile, the lack of release of market-moving data will limit price fluctuations as the U.S. market will be closed for the Martin Luther King Jr. day holiday.

Fundamentally, the US dollar, which was weighed down by the benchmark interest rate expectation of only 25 bps at the Fed's policy meeting in February, supported the pound sterling to strengthen. Then how technically, see the following analysis:

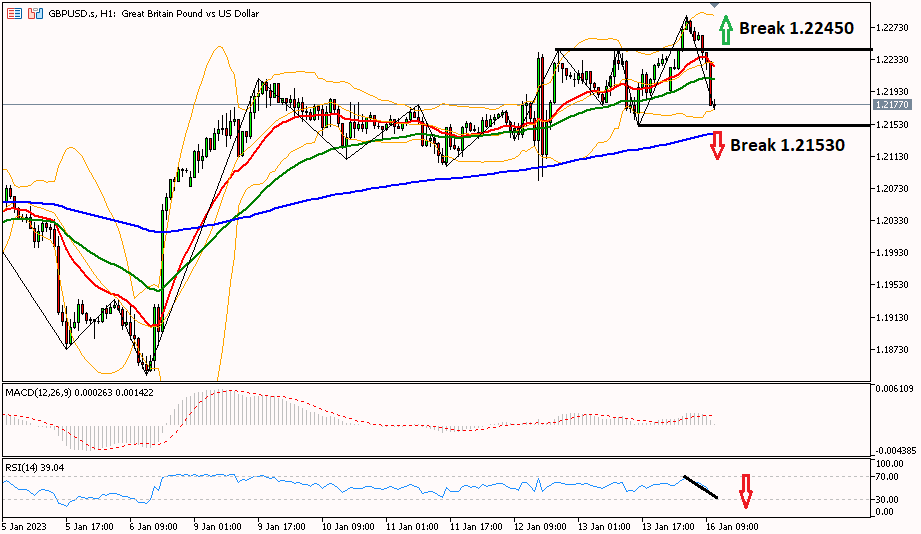

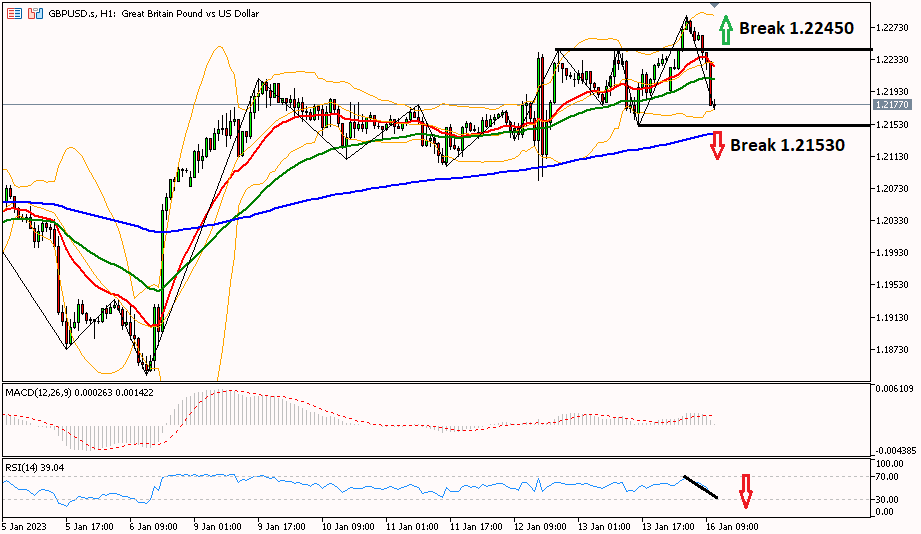

Technical Analysis

The pound is observed to be consolidating, for further declines it is necessary to break the 1.21530 area to the third support (S3) at 1.20750. While the MA20 line attempting to cross the MA50 line could confirm further bearishness.

To continue the bullish trend, GBP/USD needs to break the resistance level of 1.22450 again to the strongest daily resistance in the area of 1.23680.

This GBPUSD analysis is a fundamental and technical view of Forex today used by the author, and does not constitute advice or a solicitation. To get more information click on the image below.

Last:

Last: