Jakarta, GIC Trade – The latest macroeconomic data from the United States (US) pushed gold prices to a six-month high after the economy and labor market in the US showed signs of slowing down. The NFP data for December rose by 223,000, slowing down from the growth of 256,000 that occurred in the November 2022 period.

Meanwhile, one of the positive drivers for gold from last Friday's report, January 6, 2023, was the decline in wage rates, which is a sign that the inflation rate is easing. Where the average hourly income for the year-on-year period increased by 4.6 percent, below market expectations of 5 percent.

"Overall [the report] shows the economy is slowly moderating with inflation falling and the labor market still strong. There's no recession about this report, but it's also a mixed report that has something for everyone," MKS PAMP head of metals strategy Nicky Shiels said, citing Kitco.com.

In addition, the services sector in the US contracted for the first time in 30 months, with the Purchasing Managers' Index (PMI) reading reaching 49.6 percent.

Andrew Grantham, senior economist at CIBC Capital Markets, said that recent Gross Domestic Product (GDP) growth held much better than expected in the fourth quarter of last year. Meanwhile, the decline in the services sector will raise concerns that the economy is losing momentum quickly and that 2023 will start off on a weak footing.

World gold prices soared, responding to both data releases and reaching a daily high of $1,880 per troy ounce to date, which is also the highest level since last June. Gold surged higher, Shiels said, amid a sharp decline in business activity and orders, which, if maintained, would raise concerns about the demand outlook.

Shiels also added that what gold does next will be crucial in determining whether the precious metal can sustain its rally.

The next target that gold needs to break is around $1,896.50 per troy ounce, which is a 61.8% retracement of the decline since last March's peak near $2,070, Bannockburn Global Forex managing director Marc Chandler told Kitco News.

Fundamentally, data on the labor market and also the declining service sector in the US boosted gold prices. Then how technically, see the following analysis:

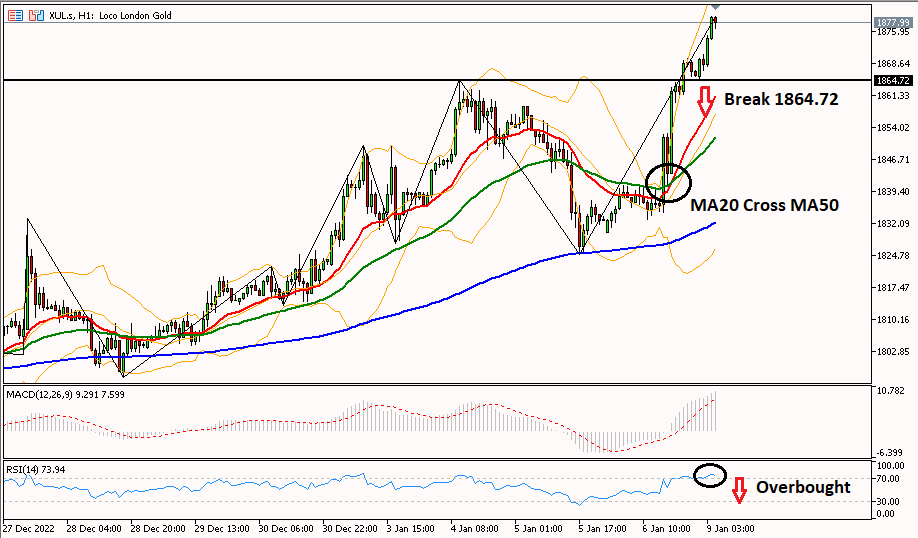

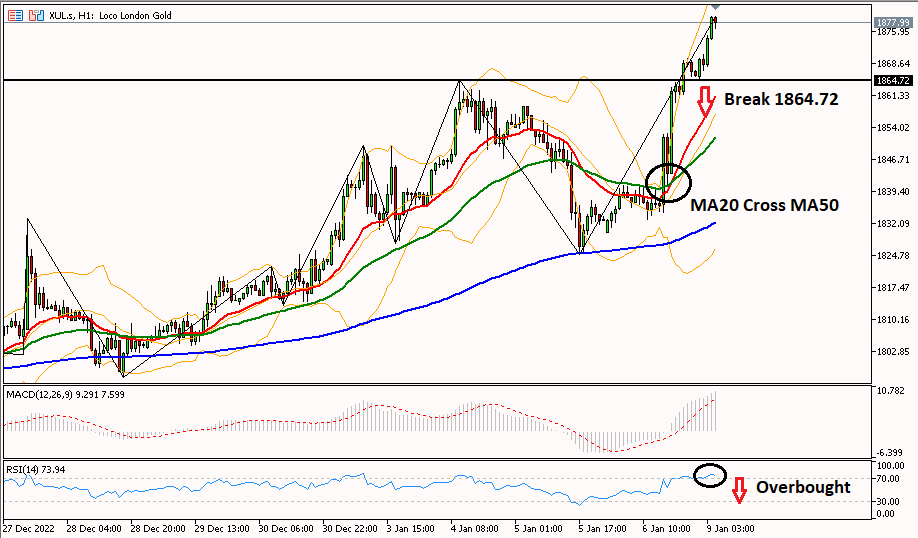

Technical Analysis

Gold prices have a chance to correct trying to break through the support level in the area of $1,864.72 to the next support at $1,850, which is confirmed by the RSI indicator which is already in the overbought area.

Gold prices have a chance to correct trying to break through the support level in the area of $1,864.72 to the next support at $1,850, which is confirmed by the RSI indicator which is already in the overbought area.

However, if gold is able to break through the resistance level at $1,888.00 then the bullish bias will continue until the $1,907 area. Gold's bullish trend is also supported by the MA20 line which crosses the MA50 line from below.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below or click here.

Last:

Last: