Jakarta, GIC Trade – In the latest oil market report published on Friday, the International Energy Agency (IEA) said that "OPEC+ supply cuts risk exacerbating the expected oil supply deficit in the second half of 2023," which could lead to high prices that will hurt consumers and threaten economic growth.

The Organisation for Economic Co-operation and Development (OECD) said that inventories in January jumped 53 million barrels to 2.830 trillion barrels, the highest since July 2021.

Russian oil exports in March rose to their highest level since April 2020, with oil shipments rising by 600,000 barrels per day. Meanwhile, the flow of Russian oil products returned to the level last seen before Russia invaded Ukraine.

Rising global oil stocks may have contributed to the OPEC+ decision. A gain of 1 million bpd from non-OPEC+ starting in March will fail to offset a 1.4 million bpd decline from OPEC+.

Extra cuts by OPEC+ will push world oil supplies down by 400,000 barrels per day by the end of 2023. Meanwhile, OECD demand shrank by 390,000 bpd YoY in Q1 due to weak industrial activity and warm weather.

Non-OECD countries led by China will account for 90% of demand growth. Global oil demand will increase by 2 million bpd in 2023 to a record 101.9 million bpd.

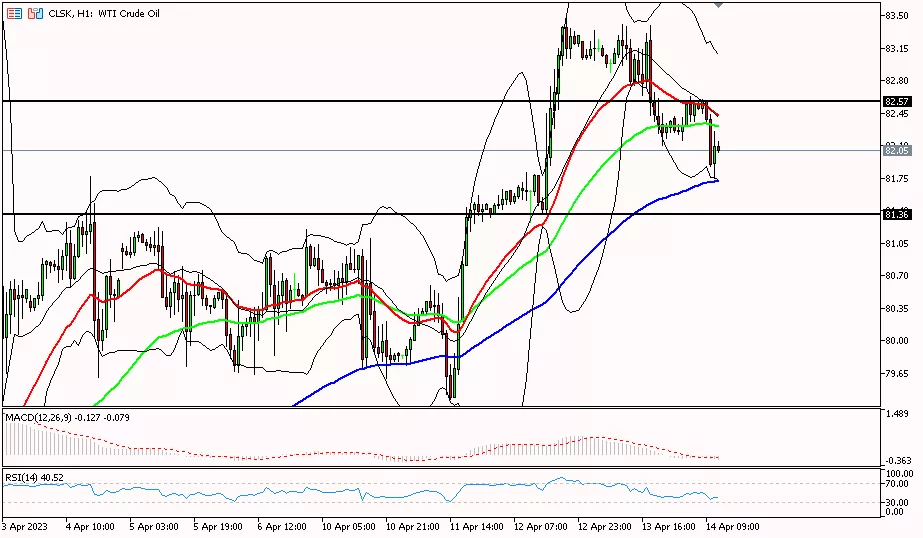

WTI oil prices struggled near $82 after the IEA oil market outlook. U.S. oil is down about 0.41% today.

Fundamentally, production cuts by OPEC+ have caused oil prices to rise, while demand for globak oil which will increase by 2 million barrels per day has fallen supporting further price increases. Then how technically, see the following analysis:

Technical Analysis

Oil prices in the 1-hour period tried to rebound, testing the resistance area of 82.57 until heading to the next resistance level at 83.14. Meanwhile, for further bearish bias, oil prices need to pass the support level of 81.36 to reach the next support level at 80.54.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Last:

Last: