Jakarta, GIC Trade – WTI crude futures surged above $74 a barrel on Wednesday, rising for a third straight session to their highest level in three weeks, as warnings from the Saudi energy minister sparked fears of further OPEC+ production cuts.

Saudi Arabia's Prince Abdulaziz bin Salman told speculators to be "cautious," in what analysts saw as a signal that OPEC+ could consider further production cuts at its June 4 meeting.

Meanwhile, industry data showed that U.S. crude inventories fell by about 6.8 million barrels. last week, defying forecasts for a rise of 0.525 million. Gasoline inventories also fell by around 6.4 million, while distillate inventories fell by around 1.8 million.

The data comes ahead of the Memorial Day holiday, which traditionally marks the start of the peak of U.S. summer travel. Elsewhere, investors continue to monitor debt ceiling negotiations in the U.S. as there are few indicators of progress being made even as the risk of a default predicted in early June looms.

Considering the continued results from CME Group for the crude oil futures market, open interest increased by about 9.7k contracts on Tuesday, adding to the previous daily gains. Volume rose by around 206.8 thousand contracts, reversing the previous daily decline.

WTI prices extended a positive start to the week amid rising open interest and volume on Tuesday. Against that, the commodity could see a rebound upward push and shift its focus to the key barrier at $80.00 per barrel, an area that is also reinforced by the 200-day SMA.

Fundamentally, OPEC+'s plan to consider further production cuts at the June 4 meeting and also U.S. crude inventories falling by around 6.8 million barrels have pushed oil prices higher. Then how technically, see the following analysis:

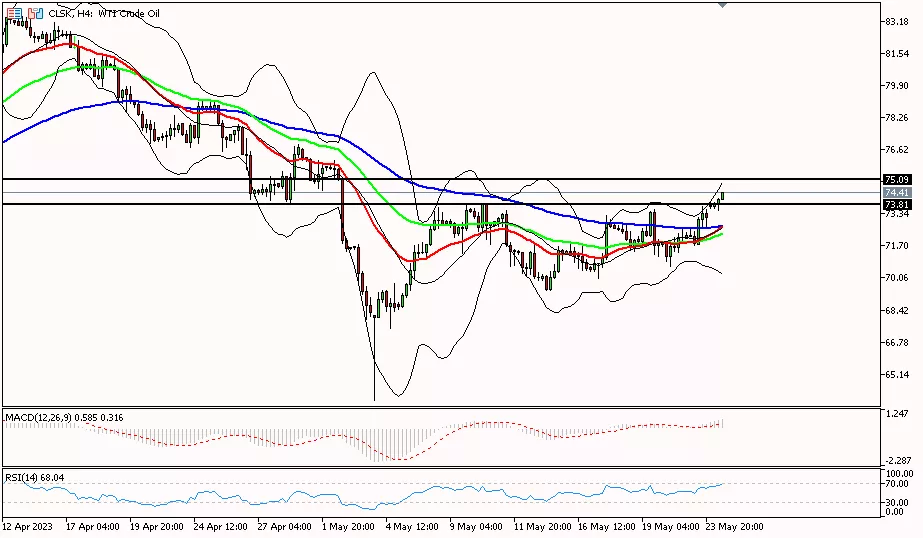

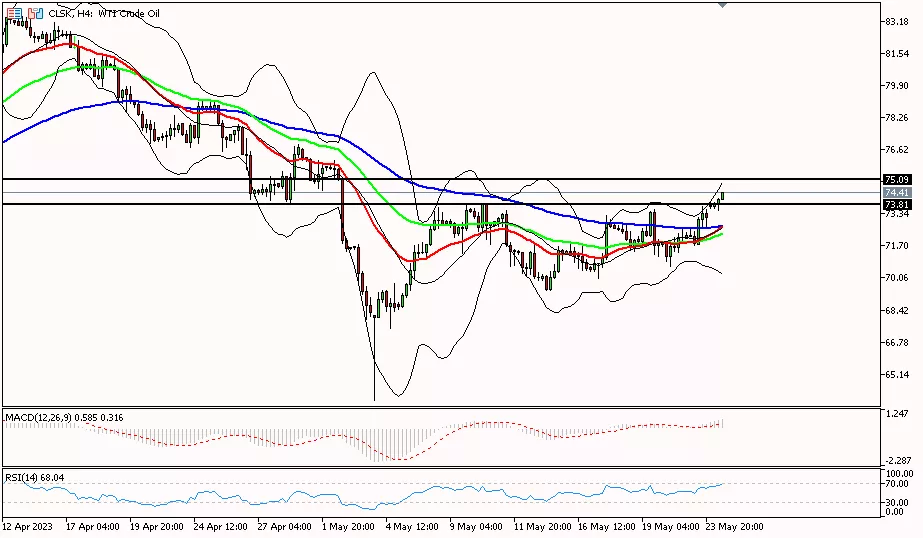

Technical Analysis

Oil prices in the 4-hour period moved further up, needing to break through the resistance area at 75.00 to strengthen its bullish bias, until it reaches the next resistance level at 76.10. Meanwhile, to change the bias to bearish, the oil price needs to pass the support level at 73.80 again to the next support level at 73.00.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Last:

Last: