Jakarta, GIC Trade – World crude oil prices in trading on Friday, January 13, 2023, rose again by 0.5 percent after previously rising by around $1 per barrel on Thursday amid optimism over the prospects for Chinese demand.

At the time of writing crude oil prices were at $78.70 per barrel.

China, one of the world's biggest oil importers, has been reopening its economy after ending strict COVID-19 restrictions, raising hopes of higher oil demand.

In addition, the US dollar plunged to its lowest level in almost 9 months against the euro after inflation data raised expectations that the Federal Reserve (The Fed) will be less aggressive with its benchmark interest rate hikes.

"The market is looking ahead to the CPI data and the strong likelihood is that it will cause the dollar to fall, with the inverse correlation boosting crude oil supply," said Bob Yawger, director of energy futures at Mizuho in New York. "Crude is enjoying a weaker dollar right now."

Supporting the increase in crude oil prices is also because the market is also preparing for additional restrictions on Russian oil supplies due to sanctions over the invasion of Ukraine.

The US Energy Information Administration said the European Union's (EU) upcoming ban on seaborne petroleum product imports from Russia on February 5 could be more disruptive than the EU's ban on seaborne crude oil imports from Russia that was implemented in December 2022.

However, limiting oil's gains was a big jump in U.S. crude inventories, which rose by 19 million barrels in the week to Jan. 6 to 439.6 million barrels. Analysts polled by Reuters had expected a decline of 2.2 million barrels.

Fundamentally, the expectation of increasing oil demand from China after the opening of the border and also the restriction of Russian oil supply has supported oil prices to rise further. Then how about technically, see the following analysis:

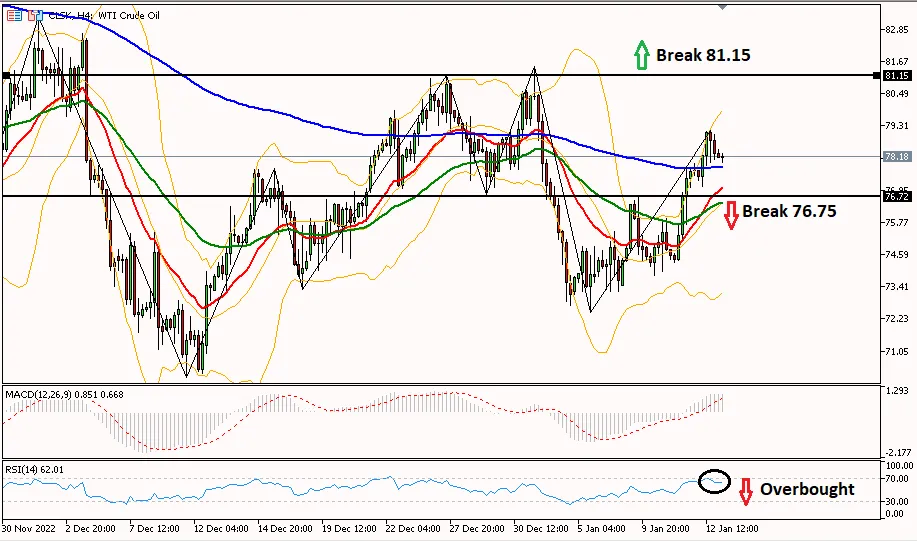

Technical Analysis

Crude oil prices are trying to touch the strongest resistance level at $81.15 per barrel. It needs to pass the first resistance at $79.30 first for oil with the next resistance at $80.30. Further increases have been supported by the MA20 indicator which has cut the MA50 line from below.

Meanwhile, to change the bias to bearish, it is necessary to break the $76.75 area in the middle of the RSI indicator which shows overbought and continue to the strongest support area at $75.20.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. For more information, click the image below.

Last:

Last: