What is Evening Star Candle

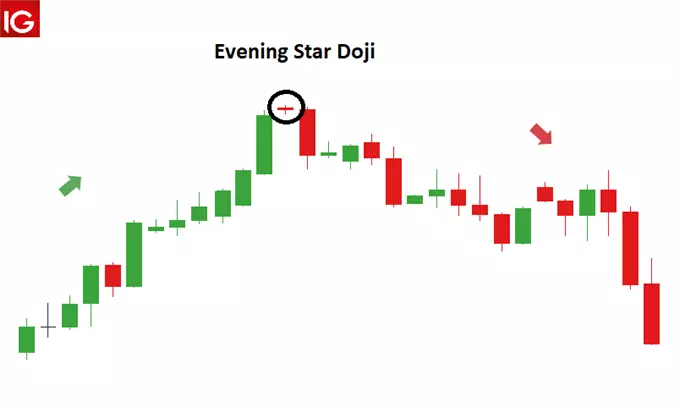

Evening star candle is a three-star candlestick pattern that usually occurs at the top of the market and will be seen when the market starts to fall. This pattern is a strong indicator used as a sign that a downtrend has started. Usually this pattern will form over a period of three days.

On the first day, you will see a large white pattern indicating a continued increase in prices in the market. Then the second day will be followed by a relatively smaller candle pattern as a sign that the price increase will be smaller, while on the third day a large red candle pattern will usually be seen as a sign that the price is below the second day and ends in the middle of the first day. For information, the evening star candle itself is the opposite of the morning star candle.

Difference between Evening Star Candle and Morning Star Candle

Unlike the evening star pattern, the morning star pattern is more likely to signal a trend reversal from bearish to bullish. The first candle of the morning star pattern is a long bearish candle that indicates momentum in the price decline. The third candle is a bullish candle that proves a reversal and covers most of the losses in the first candle. There is a gap down for the first candle to the morning star, and a gap up from the morning star to the confirmation candle. In addition to the evening star and morning star, there are also other star patterns. All star patterns are reversal patterns that can help traders make buy or sell decisions. Although there is always debate about technical analysis used for profitable investment tools, the evening star pattern itself is considered an accurate indicator in predicting bearish.

How to Recognize Evening Star Candles for Forex

Recognizing the evening star candle pattern on a forex chart involves more than just recognizing the three main patterns. All you need to do is understand how the previous price action was and where the pattern appears in the existing trend. Here's how to recognize the evening star candle pattern:

- Apply an uptrend to the market: in this case the market must first show the highest and lowest points in the market.

- Big bullish candlestick: a big bullish candlestick is the result of big buying pressure with long term trading because there is no evidence of a reversal yet.

- Small bearish candlestick: The second candlestick pattern is a small candlestick pattern (sometimes a Doji candle) that shows the first sign of a weak uptrend. The reason is, often the gap in this candlestick leads to more. It doesn't matter if the candlestick is bearish or bullish, but because the main conclusion is that the market is a bit indecisive.

- Large bearish candlestick: The first most visible sign comes from the new selling pressure that is revealed on this candle. In non-forex markets, this candle gaps down to the close of the previous candle, signaling the start of a new downtrend.

- Price action: After a successful reversal, traders will watch for highs and lows. However, traders should always manage the risk of a failed move by using well-placed stops.

Strategy Using Evening Star Candle For Trading

Ideally, traders should look first at the opening of the next candle, but if you are a traditional trader, you can delay entering and rather wait to see the action move lower. However, by doing this, you risk entering at a much worse level of a volatile market. In addition, you can place targets at previous support levels or at previous consolidation areas.

Evening Star Trading Strategy With Bollinger Bands

As we explained earlier, the evening star candle can be combined with several indicators, one of which is Bollinger Bands. This method is good for knowing when the market will be overbought. If the price bounces high from the upper band, it means that the market has expanded upwards, so in this case you can expect it to reverse. However, what many people don't think about is that the location of the upper and lower Bollinger Band indicators depends on volatility. If volatility is high, the Bollinger Bands will move away, and vice versa.

Above is an advanced class article about evening star candles. Keep updating the latest information through the GIC journal which will be announced every day. You can also trade on the GICTrade application with its latest feature, an ECN account, enjoy the advantages of the latest features with the lowest spread starting from 0!

Last:

Last: