Jakarta, GIC Trade – Oil prices fell on Friday, bracing for a fourth weekly decline, as fresh economic concerns in the United States and China rekindled anxiety about fuel demand growth in the world's two largest oil consumers.

Brent crude futures fell 48 cents, or 0.64%, to $74.50 a barrel by 1:35 p.m. ET. U.S. West Texas Intermediate (WTI) crude futures fell 39 cents, or 0.55%, to $70.48.

Both benchmarks are set to fall around 1.1% for the week, which would be the longest weekly decline since November 2021.

With talk of the U.S. government debt ceiling stalling and renewed concerns that other regional banks are in crisis, there are growing fears that the U.S. will enter a recession. A decline in new loans to businesses in China and weaker economic data there at the start of the week refocused doubts about its recovery from COVID restrictions that boosted oil demand growth.

In addition, cooler inflation data from both countries suggests consumer demand is weak, said Tina Teng, market analyst at CMC Markets in Auckland.

"Oil is a growth-sensitive commodity, which is affected by these bearish factors," he said in an email.

Prices rose earlier on Friday, after falling for the previous two sessions, on some demand expectations following comments from the U.S. energy secretary that the U.S. could buy back oil for the Strategic Petroleum Reserve (SPR) after some sales were completed in June.

The U.S. government said it would buy oil when prices were consistently at or below $67 to $72 a barrel.

However, talks to raise the U.S. federal debt limit by $31.4 trillion may not reach a deal in time to prevent a government debt default, which could lead to severe market dislocations.

Fundamentally, economic worries in the United States (US) and China are reviving anxiety about the growth of fuel demand in the world's two largest oil consumers, weighing on oil prices. Then how technically, see the following analysis:

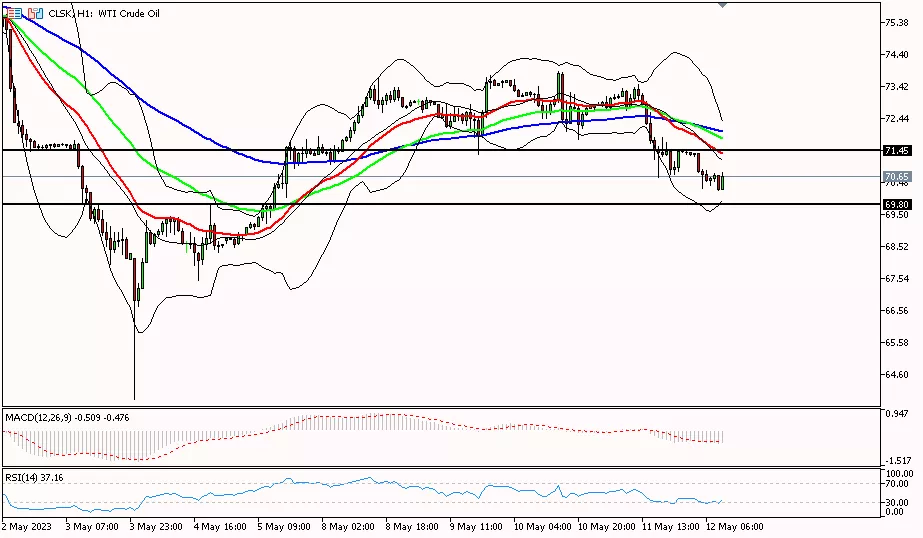

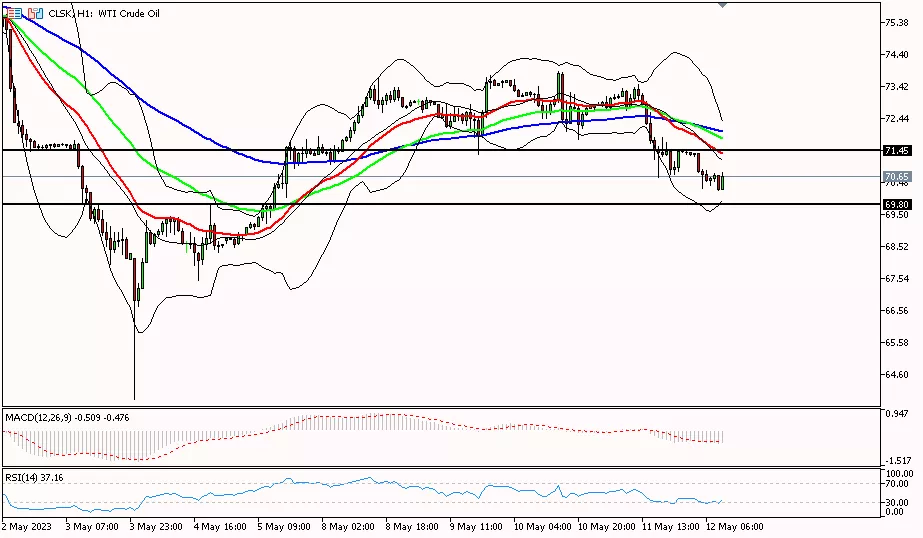

Technical Analysis

Oil prices in the 1-hour period are trying to move further down, needing to pass through the support area at 69.80 to reach the next support level at 69.00. Meanwhile, to change the bias to bullish, oil prices need to cross the resistance level at 71.45 to reach the next resistance level at 73.10.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Last:

Last: