Jakarta, GIC Trade – The World Gold Council (WGC) published a new report on Tuesday on fourth-quarter and year-to-year gold demand trends, highlighting gold purchases from retail consumers as well as from central banks that are unprecedented purchases.

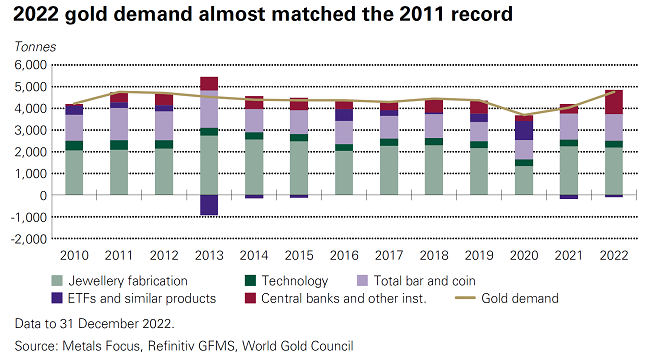

In the report, according to the WGC, in total, annual global gold demand jumped by 18% last year to 4,741 tons, which is almost equivalent to the surge in 2011. The full-year profit was helped by record demand in the fourth quarter which reached 1,337 tons.

The WGC also added that the growth in the gold market came as investment in exchange-traded bullion backing gold declined by 110 tonnes in the last year. However, the WGC said outflows in Exchange Traded Funds (ETFs) in 2022 were significantly better than the 189 tons sold in 2021.

For information, a bullion bank is a bank that conducts transactions to buy and sell precious metals.

Meanwhile, retail investors bought gold bars and coins globally rose to a nine-year high of 1,217 tons, up 2% from 2021. The report said that total investment demand rose 10% to 1,107 tons last year.

Another pillar of great power last year was demand from central banks. In the fourth quarter, central banks bought 417 tons of gold, adding to the nearly 400 tons purchased in the third quarter. The WGC said that the central bank bought 1,136 tonnes of gold last year, the highest level of purchases since 1967.

Looking ahead, the WGC said that it sees an increasing outlook for ETFs in 2023, especially as the US federal reserve is expected to end its aggressive easing cycle in the first half of this year.

Fundamentally, high global demand for gold assets supports gold prices to surge. Then how technically, see the following analysis:

Technical Analysis

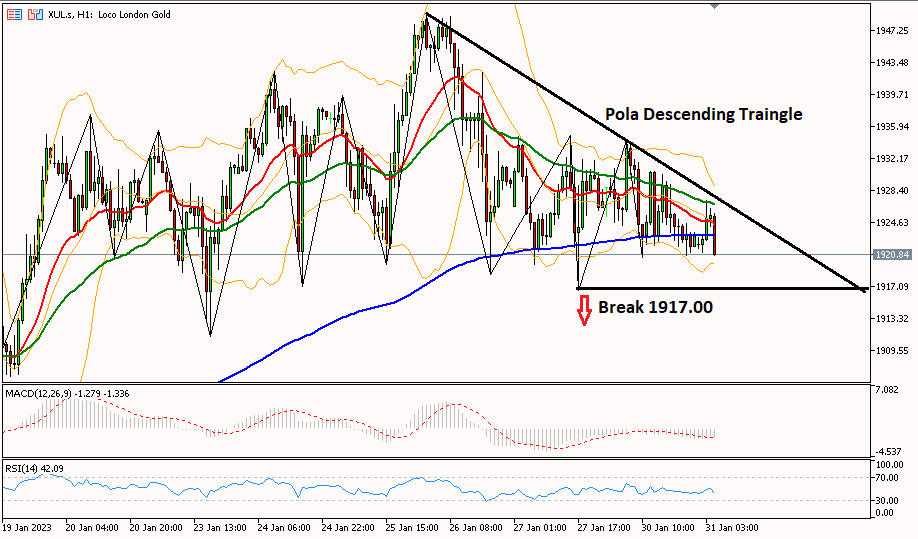

Gold prices tend to decline further which is confirmed by the Descending Triangle pattern in the 1-hour period. A further decline occurs, if the gold price is able to break through the 1917.00 support area, towards the strongest daily support level in S3 at 1905.10. However, if gold breaks the resistance of 1932.70, then the bias will change bullish to the resistance of 1940.40.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Last:

Last: