Jakarta, GIC Trade – The pound was supported by an increase in the Office for National Statistics (ONS) report which showed that the number of people filing unemployment claims in December stood at 19.7 thousand from 30.5 thousand claims in the previous period.

Other reports also show that the unemployment rate for the September-November 2022 period increased by 0.2 percentage points to 3.7 percent. Meanwhile, the average growth of total salary including bonuses and salaries excluding bonuses grew by 6.4 percent for the same period.

After the release of the data, the pound strengthened and moved above the 1.2200 level supported by revenue growth. This data increases the probability of raising the Bank of England's benchmark interest rate by 50 basis points (bps) to 74 percent.

Commenting on the UK labour market report on Tuesday, January 17, 2023, UK Chancellor of the Exchequer Jeremy Hunt said that "we should not do anything that is permanently risky, putting high inflation rates into the economy, which will only prolong the suffering for all people", quoted from Dowjones Newswire.

Nevertheless, the pound sterling is still in the shadow of the labor strike in the UK and also around recession fears that could put further pressure on the GBP/USD pair.

In addition, what puts pressure on the pound sterling is a pessimistic statement from Bank of England (BoE) Governor Andrew Bailey who stated that inflation seems to be falling drastically this year. Bailey also said there were growth concerns stemming from the workers' strike.

Fundamentally, the mixed sentiment in the UK makes the movement of the pound a little lacking in a clear direction. Then how technically, see the following analysis:

Technical Analysis

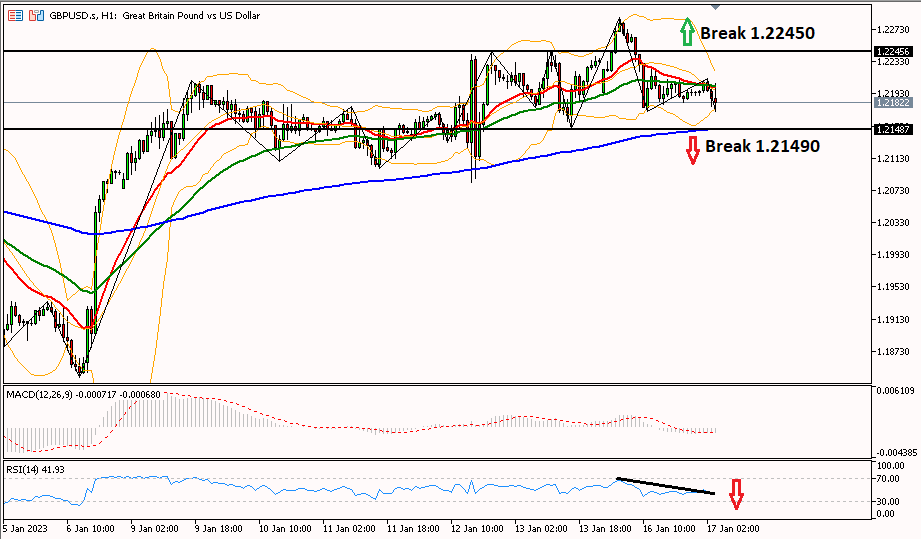

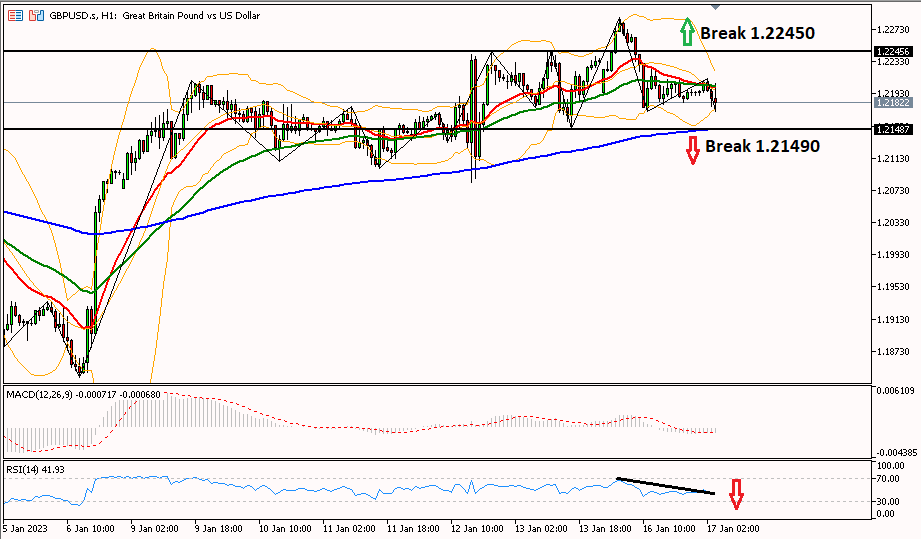

To see further movement of the pound, it is necessary to break one of the resistance support levels. GBP/USD tends to move down or correct, as seen from the RSI indicator in the 1-hour period which moves down towards the 30 area after being in the 70 area.

In addition, the MA20 line has already touched the MA50 line and is trying to cross the line, indicating a further decline. It needs a break of support at 1.21490 to change the bias to bearish until the next support in the 1.20180 area.

However, if the GBP/USD Forex pair is able to break through the resistance area at 1.22450 then the bullish bias will intensify towards the next resistance area at the level of 1.23300. Today's GBPUSD daily analysis is a fundamental and technical view used by the author, not a suggestion or solicitation.

Last:

Last: