Jakarta, GIC Trade – The Australian dollar received support for strengthening after the Reserve Bank of Australia (RBA) announced its benchmark interest rate policy.

Where the Australian dollar strengthened overall in response to positive sentiment from the hawkish RBA. RBA Governor Philip Lowe said that the RBA was firm in its determination to return inflation to the central bank's target and forecast further interest rate hikes.

The RBA at Tuesday's meeting, raised interest rates by 25 basis points (bps) to a one-decade high to 3.35% from 3.10%.

The strengthening of the Australian dollar was also driven by a weaker dollar amid profit-taking after a slight decline in US bond yields and also risk appetite or market risk appetite.

Earlier, the US dollar index, which tracks the greenback against a basket of other currencies, strengthened significantly after better-than-expected monthly US employment data. This could allow the US central bank (The Fed) to continue to raise interest rates further in the future.

Furthermore, no relevant market-driving economic data will be released from the US on Tuesday. Therefore, the focus will remain on Fed Chair Jerome Powell's speech, which will be closely scrutinized for new clues on the central bank's future rate hike path.

Fundamentally, the Australian central bank's (RBA) interest rate hike of 25 bps has supported the aussie to move higher. However, expectations of further U.S. interest rate hikes limited profits. Then how technically, see the following analysis:

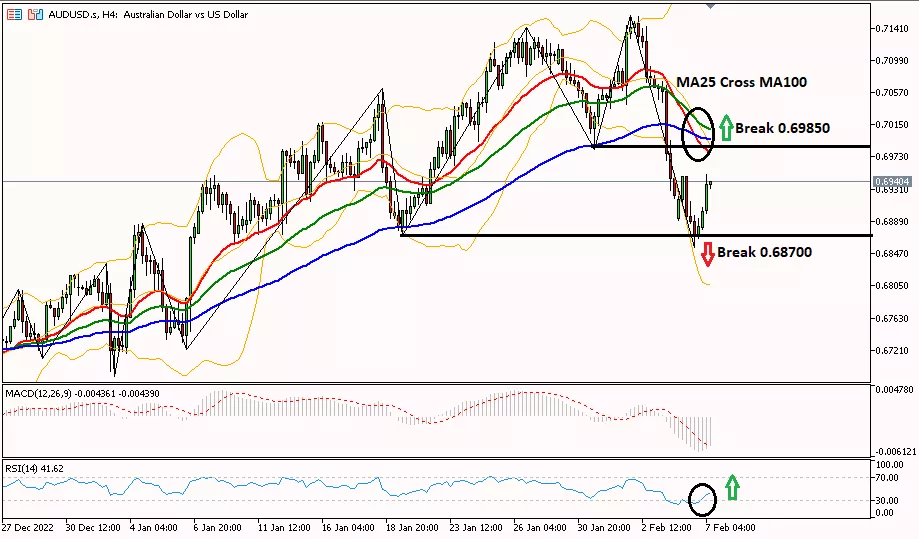

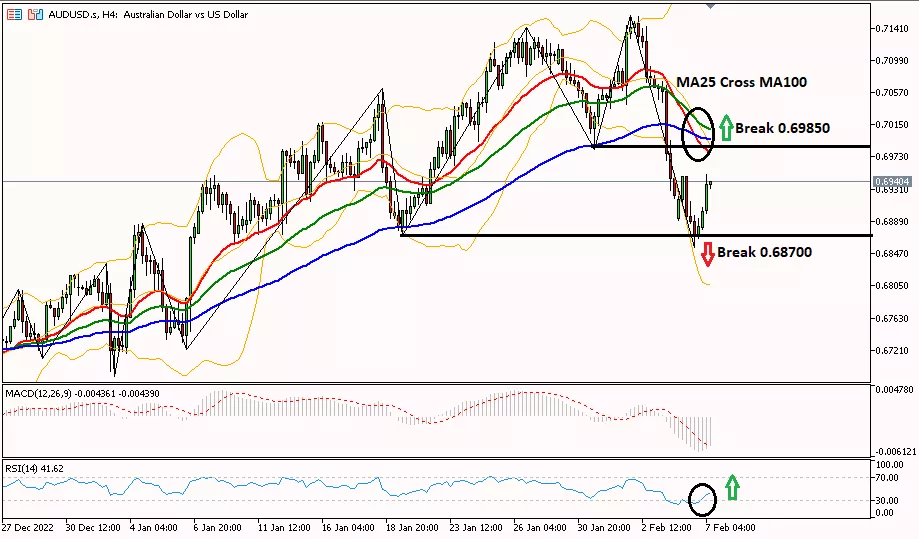

Technical Analysis

AUD/USD in the 4-hour period is trying to rebound, which is marked by the RSI indicator which is already in the oversold area. To change the bias to bullish, it is necessary to break the level of 0.69850 to test the resistance of 0.70260. However, to continue the downtrend, it is necessary to pass the support at 0.68700, to the next support at 0.68010, which is also confirmed by the MA25 line which has crossed the MA100 line.

Forex analysis today is a fundamental and technical view used by the author, not a suggestion or a solicitation. To get more information click on the image below.

Last:

Last: