Jakarta, GIC Trade – The pound was under selling pressure in Wednesday's trade amid hawkish stance from the Fed that supported the greenback and weighed on the cable. However, expectations of additional interest rate hikes by the Bank of England (BOE) could help limit losses ahead of the FOMC minutes.

The US dollar remains resilient and is near a six-week peak as expectations of further monetary policy tightening by the Federal Reserve (Fed) become the main factor weighing on the cable.

Markets are now pricing in rate hikes of at least 25 basis points (bps) at each of the next two FOMC policy meetings in March and May. Those expectations were lifted by strong US PMI numbers on Tuesday, which showed that business activity in February unexpectedly recovered to an eight-month high.

This was also supported by positive US macro data, which showed the economy remained resilient despite rising borrowing costs. In addition, some FOMC officials, including Fed Chair Jerome Powell, recently affirmed the need for a gradual sustained rate hike to fully control inflation.

Meanwhile, rising US bond yields, coupled with looming recession risks and geopolitical tensions continue to support the greenback's safe-haven currency.

Therefore, the market's focus will remain fixed on the release of the minutes of the latest FOMC monetary policy meeting. Investors will be looking for fresh clues on the Fed's rate hike path, which will play a key role in influencing the short-term US dollar price dynamics and provide a new directional boost for the GBP/USD pair.

Fundamentally, the hawkish stance of the Fed and expectations of continued interest rate hikes from the Fed weighed on the pound sterling currency. Then how technically, see the following analysis:

Technical Analysis

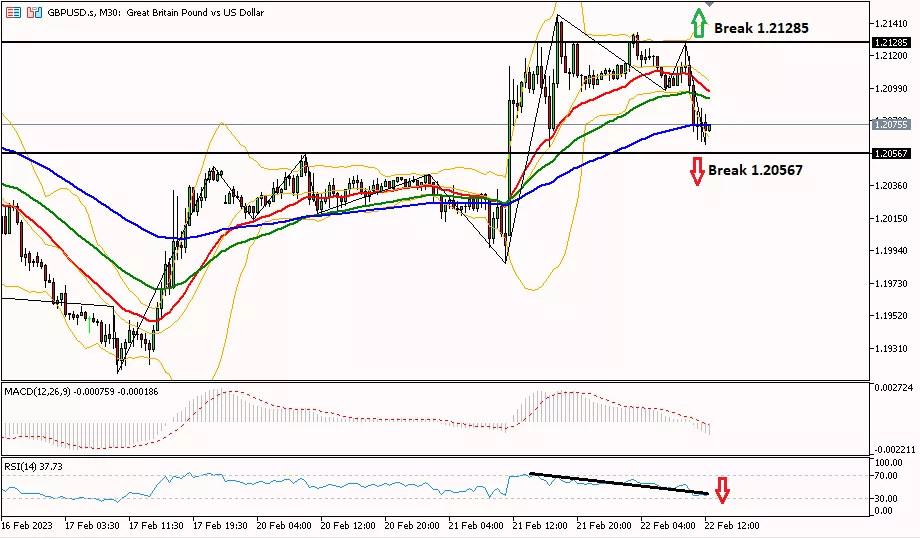

GBP/USD in the 30-minute period moved down, trying to break through the support level of 1.20567 to test the next support at 1.19930. However, with the RSI indicator almost in the oversold area or entering the 30 RSI level, the pound sterling has the opportunity to rebound. To turn the bias into a bullish one, it is necessary to break the 1.21285 area first towards the next resistance at 1.21550.

This Forex and Commodity Analysis is a fundamental and technical view used by the author, not a suggestion or a solicitation.

Last:

Last: