The following is the daily technical analysis for July 4, 2024. The data and analysis presented in this bulletin can be used broadly for your trading. However, it is important to note that GICTrade and the data providers are not responsible for your trading results.

We will now provide forecasts for price movements in Forex and Commodities, along with calculations of Pivot Points, Resistance, and Support levels.

USDCHF

USD/CHF on the 1-hour timeframe is above the pivot area at 0.90220, attempting to move up to the first resistance area at 0.90580 and then toward the second resistance area at 0.90870. Meanwhile, the RSI indicator is above the pivot area, suggesting that the Swiss Franc has the potential to move up further.

Suggest: Buy 0.90100 TP1 0.90300 TP2 0.90500 SL 0.89900

USDCHF

USD/CHF on the 1-hour timeframe is above the pivot area at 0.90220, attempting to move up to the first resistance area at 0.90580 and then toward the second resistance area at 0.90870. Meanwhile, the RSI indicator is above the pivot area, suggesting that the Swiss Franc has the potential to move up further.

Suggest: Buy 0.90100 TP1 0.90300 TP2 0.90500 SL 0.89900

|

PREVIOUS RANGE |

||||||

|

OPEN |

HIGH |

LOW |

CLOSE |

PREV.CLOSE |

CHANGE |

%CHANGE |

|

0.90380 |

0.90504 |

0.89856 |

0.90144 |

0.90393 |

-0.00249 |

-0.28% |

|

DAILY PIVOT POINT |

||||||

|

R3 |

R2 |

R1 |

PIVOT |

S1 |

S2 |

S3 |

|

0.91230 |

0.90870 |

0.90580 |

0.90220 |

0.89940 |

0.89570 |

0.89290 |

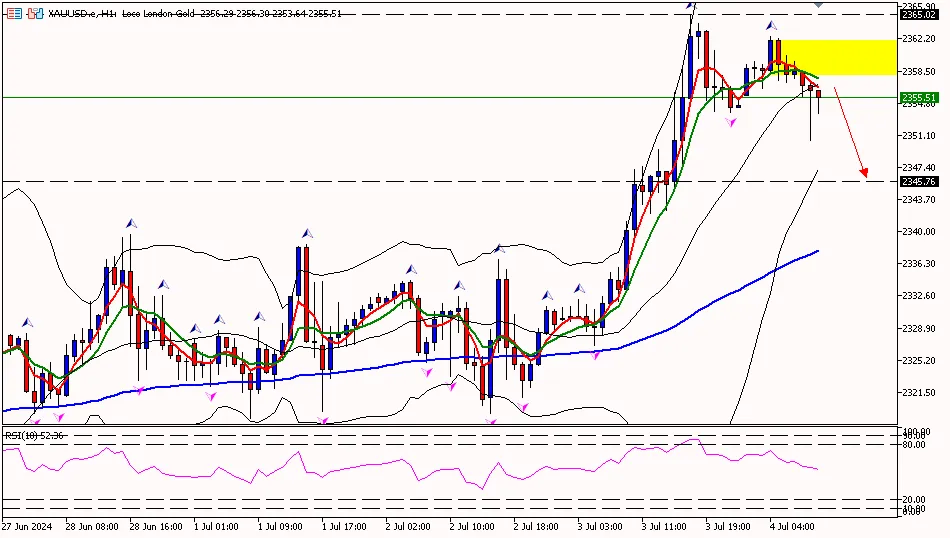

XAUUSD

The price of gold on the 1-hour timeframe is below the first resistance area at 2361.30, attempting to move down toward the pivot area at 2344.10 and then toward the first support area at 2323.30. Meanwhile, the RSI indicator is above the pivot area, suggesting that the price of gold has the potential to move up first before going down.

Suggest: Sell 2360.00 TP1 2355.00 TP2 2345.00 SL 2365.00

|

PREVIOUS RANGE |

||||||

|

OPEN |

HIGH |

LOW |

CLOSE |

PREV.CLOSE |

CHANGE |

%CHANGE |

|

2329.89 |

2364.95 |

2326.93 |

2354.57 |

2329.35 |

25.22 |

1.08% |

|

DAILY PIVOT POINT |

||||||

|

R3 |

R2 |

R1 |

PIVOT |

S1 |

S2 |

S3 |

|

2399.30 |

2382.10 |

2361.30 |

2344.10 |

2323.30 |

2306.10 |

2285.20 |

CLSK (OIL)

The price of oil on the 1-hour timeframe is below the pivot area at 83.34, with the potential to move down to the first support area at 82.77 and then toward the second support area at 81.87. Meanwhile, the RSI indicator is below the pivot area, suggesting that the price of oil has the potential to move down further.

Suggest: Sell 83.40 TP1 83.00 TP2 82.60 SL 83.80

|

PREVIOUS RANGE |

||||||

|

OPEN |

HIGH |

LOW |

CLOSE |

PREV.CLOSE |

CHANGE |

%CHANGE |

|

83.16 |

83.91 |

82.44 |

83.67 |

83.02 |

0.65 |

0.78% |

|

DAILY PIVOT POINT |

||||||

|

R3 |

R2 |

R1 |

PIVOT |

S1 |

S2 |

S3 |

|

85.71 |

84.81 |

84.24 |

83.34 |

82.77 |

81.87 |

81.30 |

Well, that’s the explanation about "Daily Technical Analysis: July 4, 2024 – US Dollar Attempts to Rebound." Also, read our other articles, such as the explanation on how to buy cryptocurrency, only at Jurnal GIC. Don’t forget to hone your trading skills by getting the Ebook Scalping guidebook. Make sure to download the GIC Mobile App on the Google Play Store.

Last:

Last: