Jakarta, GIC Trade – The Japanese yen surged after the decision of the Bank of Japan (BoJ) to maintain monetary policy and yield curve control unchanged.

At the two-day policy meeting, the BOJ unanimously kept the yield curve control target intact, set at -0.1% for short-term interest rates and around 0% for 10-year tenors.

BoJ Governor Haruhiko Kuroda in a conference after the policy meeting said that he would continue monetary easing to achieve a sustainable and stable inflation target.

Kuroda also added that he would not hesitate to further ease monetary policy if necessary. Meanwhile, the consumer price index is around 3 percent and will fall below 2 percent for the next fiscal year.

The yen's weakness occurred as market participants hoped that the BoJ would further ease yield curve control policies, resulting in the Japanese yen experiencing its worst day since mid-December.

Nordea chief analyst Niels Christnesen said "the BoJ is likely surprised by the reaction to the policy change in December which may be the reason why they are not taking new initiatives".

Fundamentally, the BoJ's decision to maintain monetary policy has disappointed market participants' expectations, weighing on the Japanese yen. Then how technically, see the following analysis:

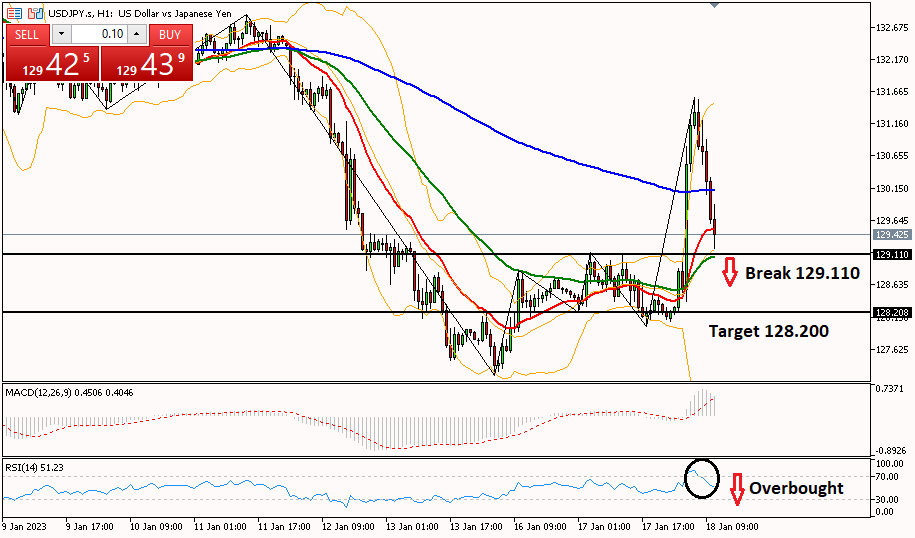

Technical Analysis

The USD/JPY pair was observed to move down in the 1-hour time frame, with the RSI indicator in the overbought area indicating a decline. It needs to break the 129,110 support again for further bearishness towards the 128,200 target.

Meanwhile, the bias will be bullish again if USD/JPY is able to break through the 130,000 resistance level and continue to the 131,000 area. The bullish bias is also supported by the MA20 line which still intersects with the MA50 line at the 1-hour TF.

This Forex analysis is a fundamental and technical view used by the author, not a suggestion or a solicitation. To get more information click on the image below.

Last:

Last: