Jakarta, GIC Trade – WTI crude futures were slightly higher above $71 a barrel on Tuesday, as investors assessed the demand and supply outlook.

Earlier in Monday's trading, oil prices rose a dollar per barrel after three consecutive sessions of decline, driven by the prospect of tightening supplies in Canada and elsewhere, although recession fears continued to weigh on the market. Wildfires raged in Alberta, Canada, shutting off a large supply of crude, and prices rose as fears worsened, Mizuho analyst Robert Yawger said.

In its May report, the International Energy Agency (EIA) raised its forecast for global oil demand by 200,000 barrels per day and forecast tighter market conditions in the second half of the year, with demand projected to exceed supply by nearly 2 million barrels per day.

While the U.S. Department of Energy also announced its intention to buy up to 3 million barrels of crude for the strategic oil reserve, it provided some support for oil prices.

On the other hand, China's recent industrial production data showed a slowdown in the economic recovery, raising concerns about a decline in demand from the world's largest crude importer. Nonetheless, China's crude oil refinery figures revealed an annual increase of 18.9%, reaching a record second-highest high.

Fundamentally, wildfires are raging in Alberta, Canada, thus shutting off large crude oil supplies in favor of higher oil prices. While the U.S. Department of Energy also announced its intention to buy up to 3 million barrels of crude oil for the strategic oil reserve, it provided some support. Then how technically, see the following analysis:

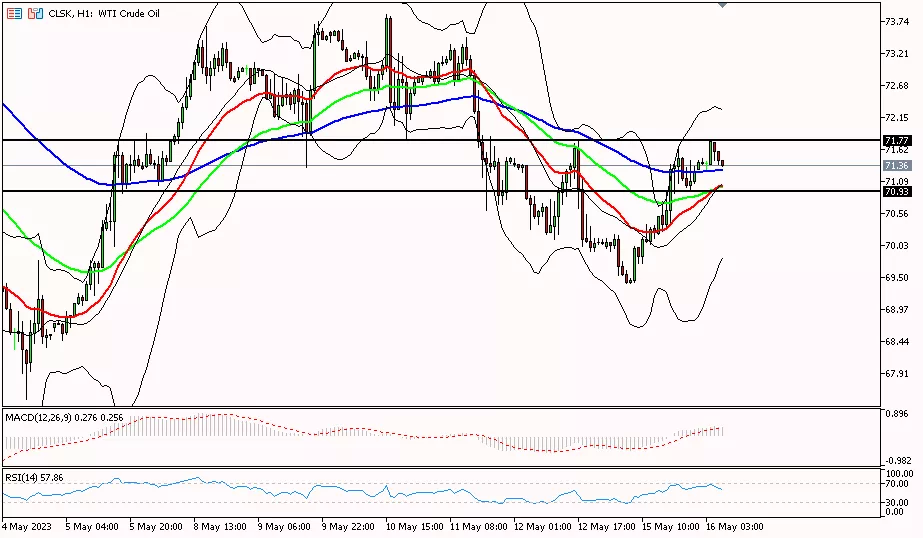

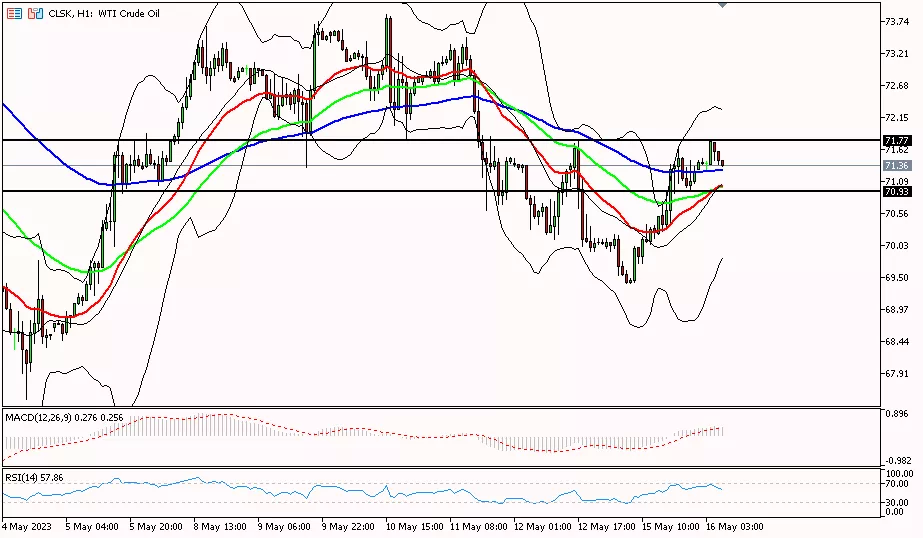

Technical Analysis

Oil prices in the 1-hour period are trying to move downwards, needing to cross the support area at 70.93 to reach the next support level at 69.87. Meanwhile, to continue the bullish bias, oil prices need to pass the resistance level at 71.77 to reach the next resistance level at 73.00.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Last:

Last: