Jakarta, GIC Trade – AUD/USD today, Wednesday experienced new selling pressure after the release of consumer price index (CPI) data. Australia's weaker CPI reiterated bets that the RBA will halt its rate-hiking cycle. A good increase in USD demand further contributed to the intraday decline.

The AUD/USD pair struggled to capitalize on the previous day's positive move and came under fresh selling pressure on Wednesday. The steady intraday decline continued throughout the early European session and dragged spot prices to new daily lows, around the 0.6675-0.6670 region in the past hour.

The Australian dollar weakened in reaction to weaker-than-expected domestic consumer inflation figures for February, which reiterated bets that the Reserve Bank of Australia (RBA) will refrain from raising interest rates at its April meeting.

In fact, the Australian Bureau of Statistics (ABS) reported that headline CPI slowed from the previous month's reading of 7.4% to an annual rate of 6.8%, or the lowest in eight months in February. In addition, the emergence of several US Dollar (USD) buying actions is seen exerting downward pressure on the AUD/USD pair.

Meanwhile, the recent rally in US Treasury bond yields, supported by easing fears of a widespread banking crisis, helped the USD halt a two-day losing streak. That said, the Federal Reserve's less hawkish stance, along with the prevalent risk-off environment, could limit the safe-haven buck/greenback's gains and provide support to the AUD/USD pair.

Keep in mind that the Fed last week hinted that a pause in rate hikes is imminent. In addition, the takeover of Silicon Valley Bank by First Citizens Bank & Trust Company helped calm market jitters about contagion risks.

The mixed fundamental background mentioned above warrants caution before placing aggressive bearish bets around the AUD/USD pair and positioning itself for any further depreciation moves.

Fundamentally, weaker consumer inflation rates have given rise to expectations that the RBA will refrain from further rate hikes, thus putting pressure on the aussie currency. Then how technically, see the following analysis:

Technical Analysis

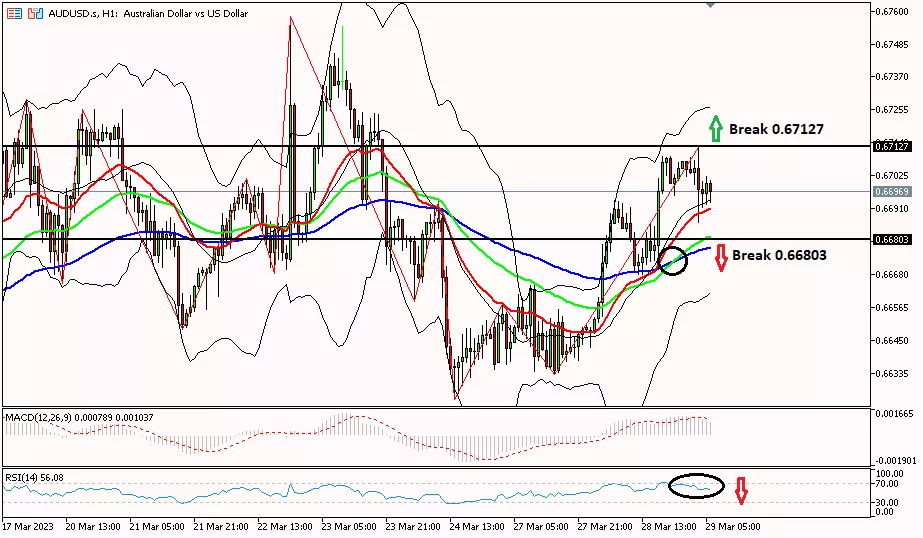

AUD/USD on the 1-hour period tried to rise further touching the resistance area of 0.67127 until heading towards the next resistance level at 0.67440. Meanwhile, to turn the bias bearish, AUD/USD needs to break through the support area at 0.66803 towards the next support level at 0.66450. The decline in the aussie can be seen from the RSI which is already in the overbought area.

This analysis is a fundamental and technical view used by the author, not a suggestion or invitation. To get more information click on the image below.

Warning!

This analysis is based on fundamental and technical views from reliable sources, and is not a suggestion or invitation. Always remember that this content aims to enrich the reader's information. Always use independent research first on other forex information to use as a reference in your trading.

Get the latest news and articles from other GIC Indonesia, you can check on Google News every day to find out the latest updates about the world of forex to crypto. Also trade on GICTrade using an ECN account to enjoy trading with low spreads starting from zero!

Last:

Last: